CALLUM THOMAS - CHARTSTORM: Financial conditions have UN-EASED, Important resistance levels remain UN-CLEARED, and investors remain ALL-IN!

READ THE ENTIRE CALLUM THOMAS ARTICLE HERE!

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

Financial conditions have un-eased.

Important resistance levels remain un-cleared.

October seasonality is bearish during election years.

Investors are all-in on stocks (and valuations are high).

We’ve never seen Fed rate cuts when valuations are this high.

Overall, there still seems to be a lot of unfinished business in the market. Technicals and macro remain mixed, valuations/sentiment/allocations elevated, and various (geo)political risks looming. Maybe it’s actually a positive sign that the market has done so well all things considered. Either way I still think the two R’s of risk management and rotation should be front of mind.

1. Tech Trying: Tech continues to try to regain its status as the leader of the US stockmarket, but remains stuck around that key overhead resistance point. Market breadth likewise remains stuck around the 60% mark. If we ignore macro and valuations and just focus on trend, you might argue that it will eventually resolve to the upside. But there are a few things going on…

Source: Callum Thomas using MarketCharts.com Charting Tools

2. Financial Conditions Uneasing: As a follow-up to last week, this chart is looking less bullish now. The previous easing of financial conditions has unwound somewhat with the US dollar, bond yields, and oil price rebounding. It raises several specters; geopolitical risk (oil), resurgence risk (dollar, rates), and overall macro headwinds into a seasonally sketchy time of the year.

Source: @Callum_Thomas using StockCharts.com

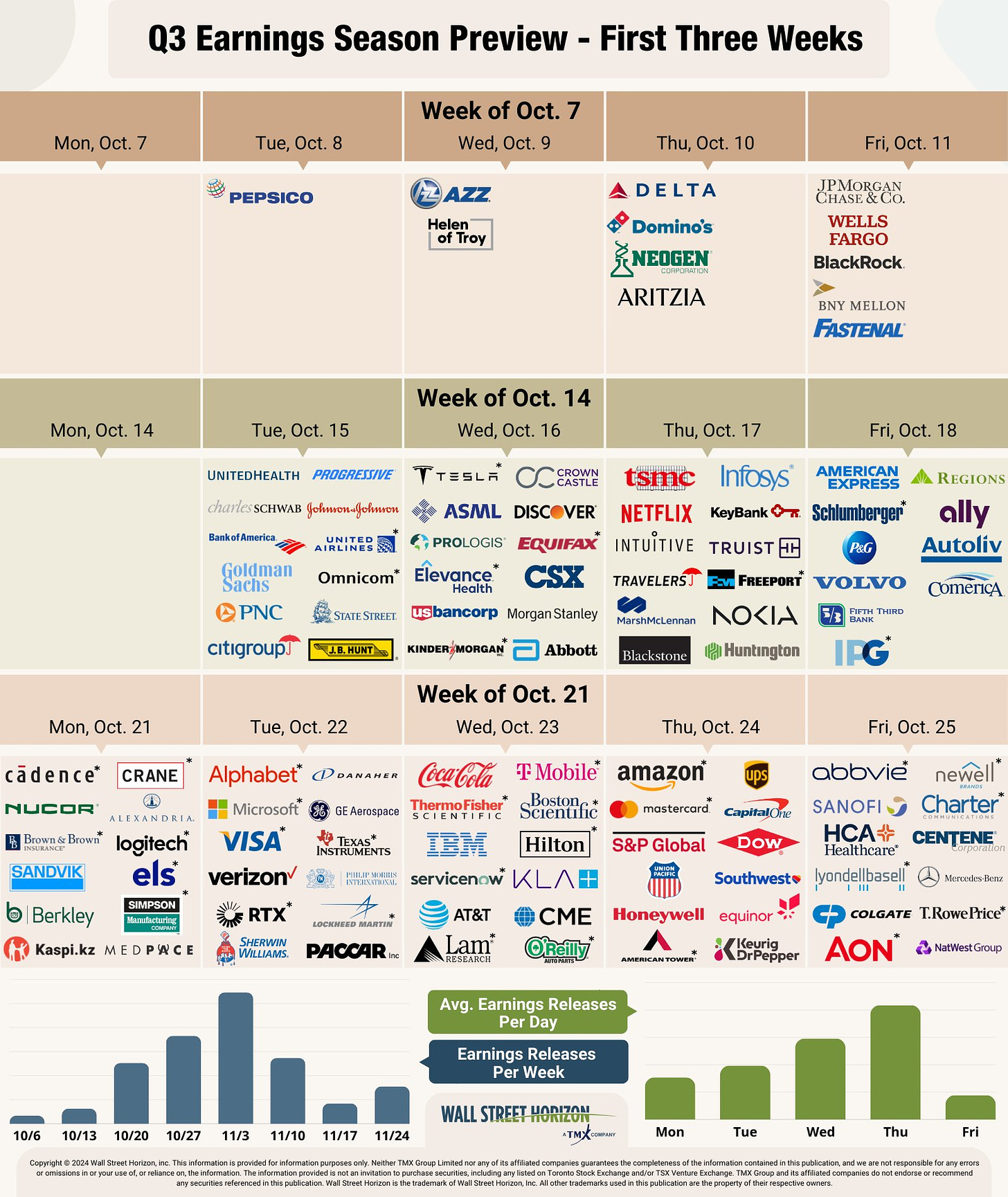

3. Earnings Season: Meanwhile, earnings season is set to kick-off next week, with Friday’s financials (JPM, WFC, BLK,BK) potentially setting the tone for what to expect with the Q3 reports.

CONTINUED…