Can Paul Tudor Jones and Stanley Druckenmiller be wrong about LONG U.S. TREASURY BONDS?

READ THE ENTIRE REALINVESTMENTADVICE.COM ARTICLE HERE!

Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on higher yields, be wrong? Instead of mindlessly assuming such legendary investors are correct, let’s do some homework.

First, though, let’s remind ourselves that Paul Tudor Jones and Stanley Druckenmiller are known for their aggressive trading styles. Therefore, we don’t know whether their bets are short term trades for a quick profit, or longer-term bets on significantly higher yields. Moreover, maybe their negative bond commentary is just “talking their books” to get traders and investors to follow them and boost their profits. Such a proven strategy by famous traders can be a recipe for losses by those who try to mimic their trades.

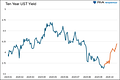

The recent 50-basis point increase in longer-term yields started the day after the Fed cut rates by 50 basis points. Some bond bears claim the Fed will rekindle inflation by cutting rates while the economy remains strong. Others fear that fiscal deficits are out of control, leading to inflation. An emerging group of bond bears, led by Paul Tudor Jones and Stanley Druckenmiller, worry that a Donald Trump Presidency and Republican control of Congress will ramp up deficits, resulting in high inflation.

Let’s address the market narratives and assess their credibility. Doing so will help us decide if following Paul Tudor Jones and Stanley Druckenmiller is a good idea.

Is Another Round Of Higher Inflation Likely?

Below is a review of some possible causes of inflation bandied about by the inflationist crowd.

CONTINUED…

Feel free to share with friends and colleagues!