READ THE ENTIRE MINING.COM ARTICLE HERE!

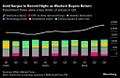

Global gold demand swelled about 5% in the third quarter, setting a record for the period and lifting consumption above $100 billion for the first time, according to the World Gold Council.

The increase — which saw volumes climb to 1,313 tons — was underpinned by stronger investment flows from the West, including more high-net-worth individuals, that helped offset waning appetite from Asia, the industry-funded group said in a report on Wednesday. Buying in bullion-backed exchange-traded funds flipped to gains in the quarter after prolonged outflows.

Gold has stormed higher this year, rallying by more than a third and setting successive records. The jump has been driven by robust central-bank buying and increased demand from wealthy investors, with recent gains aided by the Federal Reserve’s shift to cutting interest rates. Purchases in the opaque over-the-counter market were becoming an increasingly important force for prices, according to John Reade, the council’s chief market strategist.

“Demand has switched through the course of this year from predominantly emerging-market OTC buying — high-net-worth individuals — toward very much more Western OTC buying,” Reade said. OTC transactions are done through dealers or between buyers and sellers directly, without an exchange.

Gold — which set a record near $2,790 an ounce on Wednesday — has registered gains every month this year, apart from a minor pullback in January, and in June, when prices were flat. “The fact that corrections have been very shallow and short is a keen indication of FOMO buying,” Reade said in an interview, referring to investors’ so-called fear of missing out.

CONTINUED…

Feel free to share with friends and colleagues!