JOHN HUSSMAN: Investors make the REPEATED MISTAKE of basing valuations on excitement INSTEAD OF arithmetic!

READ THE ENTIRE JOHN HUSSMAN X POST HERE!

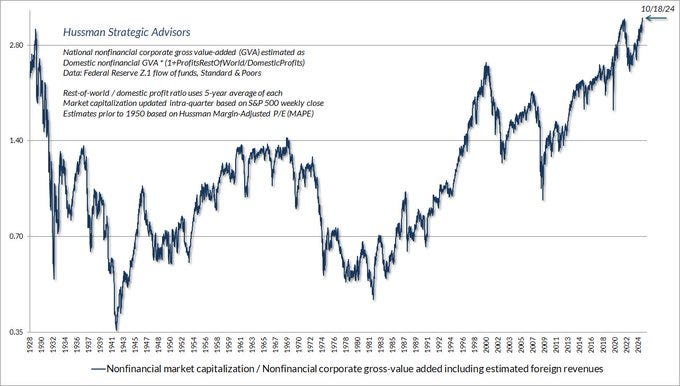

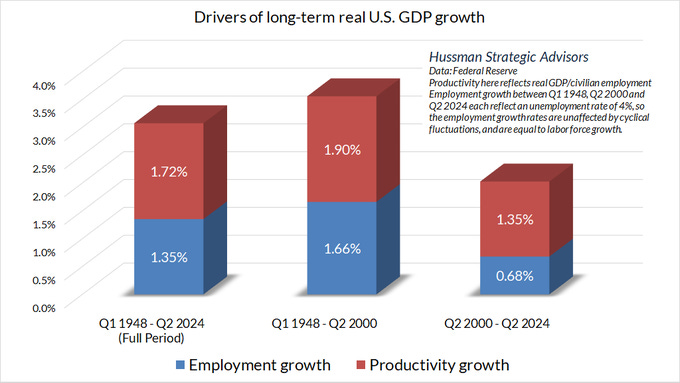

One would think that with all the society-changing technological innovation since 2000, GDP growth and S&P 500 revenue growth would have been faster, not slower, than in the past. Investors make the repeated mistake of basing valuations on excitement instead of arithmetic.

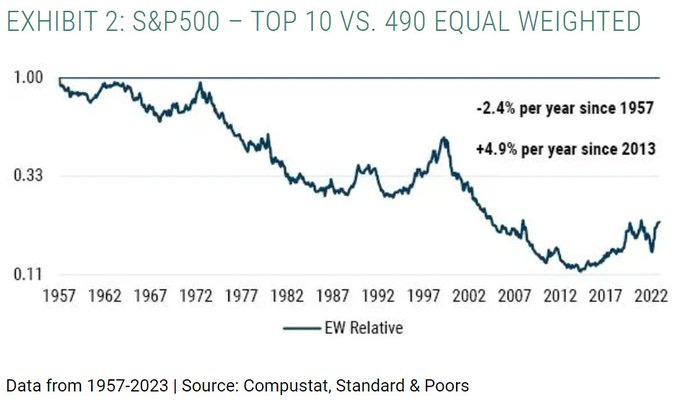

Consider the largest three tech stocks in 1999: Microsoft, Cisco, and Intel. Their total returns, respectively, since 2000 have averaged 10.38%, 1.88%, and -0.11%. Average 4.05%.

Seeing the largest companies go on to lag, as a group, is the norm, not the exception.

In contrast, compared with Microsoft's $600bn market cap, Amazon's was just $26 bn in 1999, with a price/sales multiple of 26 on a low base of revenues.

Revenue growth averaging 30% annually (from that low base) since 1999 resulted in a 17% annual return as the PSR fell.

CONTINUED…

Feel free to share with friends and colleagues!