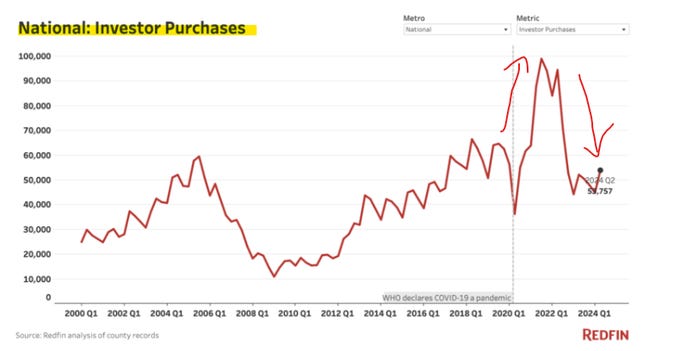

NICK GERLI: When will real estate investors start BUYING HOUSES AGAIN? When interest rates DROP FAR BELOW CAP RATES!

READ THE ENTIRE NICK GERLI X POST HERE!

When will real estate investors start buying houses again?

When interest rates drop far below cap rates.

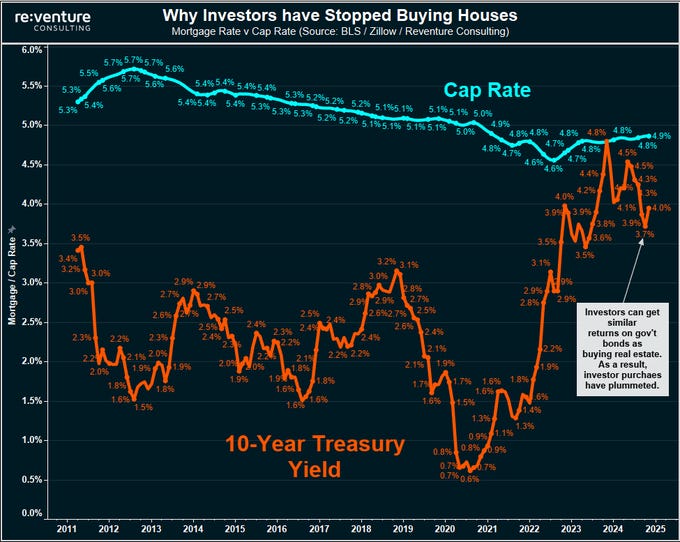

Currently, the 10-year treasury is 4.0%. And the typical cap rate for an SFR rental is 4.9%. The result is that real estate investors can earn a similar return by buying gov't bonds.

Which explains why investor purchases have plummeted.

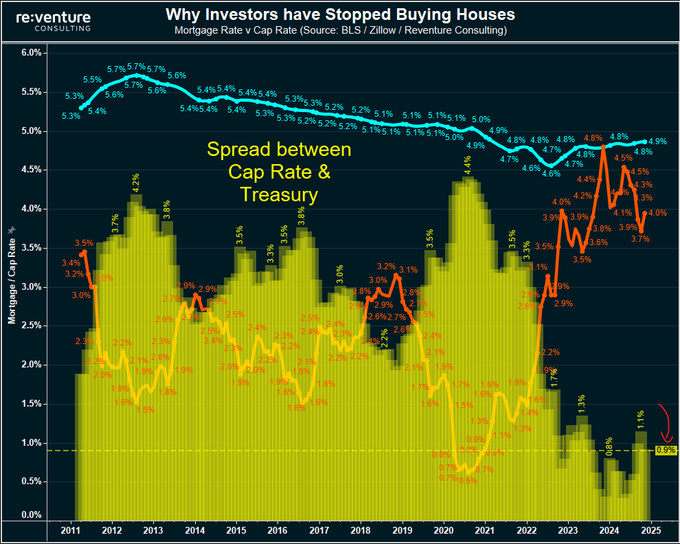

Note how from 2011-2022 there was a massive spread between Cap Rates and the 10-Year. This spread meant real estate was very attractive for investors since it provided an excess return.

It no longer does that. Either: 10-year yields need to drop substantially, or cap rates need to rise substantially, or some combination there of, to bring investors back to the market.

The spread between cap rates and the 10-year today is only +0.9%.

back from 2011-2022, the spread was more like +3.0%.

Reaching a peak of +4.4% in 2020.

No wonder investors piled into housing market back then. The risk-adjusted return told them to do so.

Everyone likes to think there's some big conspiracy about investors buying homes. Or not buying homes. Or Selling homes.

There isn't. It's just math.

If investors can make a big spread on rentals, they'll buy them. If they can't, they won't buy them.

CONTINUED…

Please feel free to share with friends and colleagues.

This is exactly why the Fed is attempting to cut rates while inflation remains high, but with the 10yr and longer duration rates now wanting to price in future inflation, rather than following short dated rates lower, it’s all a bit harder than 10 years ago…