(OLIVER GROB): NEWMONT MINING- Let's take a look at some of the key numbers and developments!

READ THE ENTIRE OLIVER GROB X POST HERE!

The world's largest gold miner, Newmont, hit a new 52-week and multi-year high earlier this week, finally catching up with the roaring 2024 gold bull run. Then some profit taking took place.

Yesterday, the American gold giant released its Q3/2024 financial results. Let's take a look at some of the key numbers and developments.

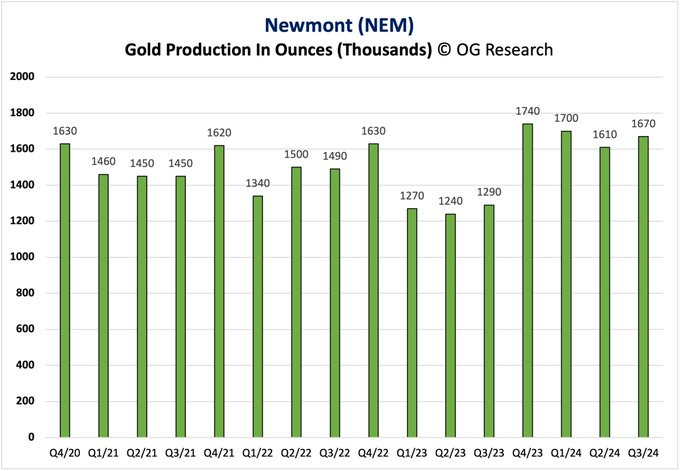

Newmont's attributable gold production increased 4% to 1.67 million ounces from the prior quarter primarily due to higher production at Cerro Negro.

Third quarter production also benefited from higher throughput at Brucejack, increased mill utilization at Ahafo and improved production at Yanacocha primarily due to the benefits of injection leaching. Overall, solid production results, but slightly below guidance, so Q4 needs to be even better.

Below you can see the gold production trend, which is back to higher levels after the massive Newcrest acquisition.

The bad news: Newmont again missed cost estimates and reported another increase in AISC - to new record highs. Newmont had previously guided for lower costs in H2. There were several factors for the latest AISC increase, including much higher costs at Lihir, Akyem and the Red Chris JV.

Overall, cost inflation has slowed but is still there. Newmont's All-in Sustaining Costs (AISC) are up more than 50% since 2020, which is massive.

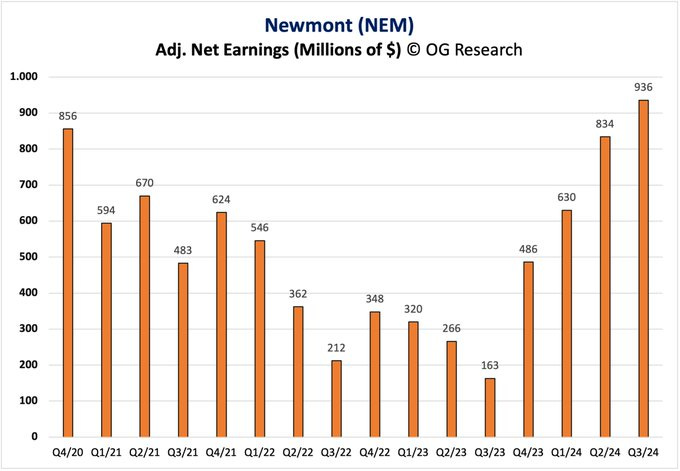

Fortunately, Newmont's earnings were once again saved by much higher gold prices. The average realized gold price in the 3rd quarter was $2,518, a sharp increase of $171 per ounce from the previous quarter. So we didn't see any margin compression and cost inflation didn't have as much of an impact on NEM's Q3 earnings (as in previous quarters).

CONTINUED…

Feel free to share with friends and colleagues!

Great post and thanks again for flagging this Metals and Miners. Not to distract from Oliver's analysis, but there appears to be quite a bit going on at $NEM beyond the numbers.