STIFEL: The stock market is in a MANIA that will PUSH IT HIGHER before a potential 26% PLUNGE in 2025!

READ THE ENTIRE BUSINESSINSIDER.COM ARTICLE HERE!

The S&P 500 could lose a quarter of its value next year, according to Stifel.

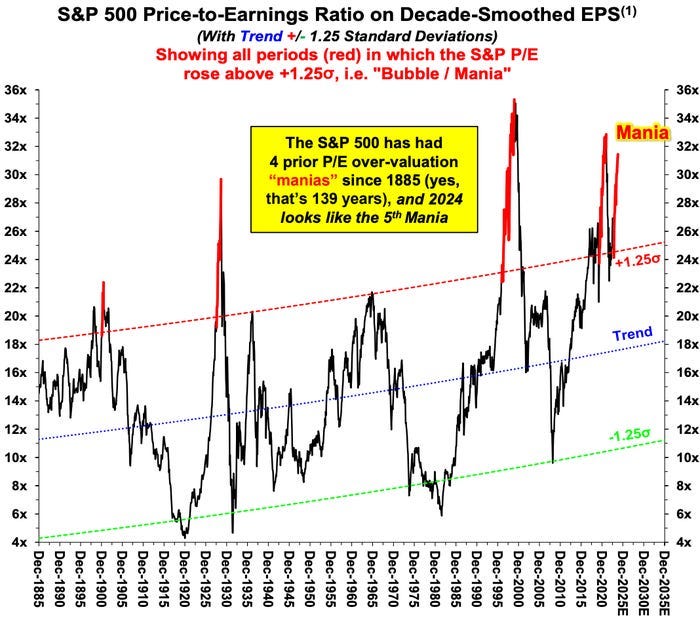

The benchmark index looks like it's caught in a "mania," the firm's strategists said in a note.

Investors could be impacted long-term, as manias tend to lead to poor returns in the next decade.

The S&P 500 looks like it's in the midst of another "mania," and investors could see a steep drop in the benchmark index sometime next year, according to Stifel.

Strategists at the investment firm pointed to lofty valuations, with the S&P 500 breaking through a series of record highs this year on the back of an improving economic outlook, expectations for Fed rate cuts, and hype for artificial intelligence.

But the benchmark index now looks similar to the past four manias that have taken place, the firm said, comparing the current investing environment to the pandemic stock boom, the dot-com bubble, and stock run-ups in the 1920s and late 1800s.

Growth returns "excess of Value" in today's market look "almost exactly the same" as they did leading up to the 1929 stock crash, the firm added.

CONTINUED…