READ THE ENTIRE YAHOO FINANCE ARTICLE HERE!

(Bloomberg) -- UK bonds fell as investors were unnerved by the government’s plans to fund investment and stimulate the economy, which could mean interest rates stay higher for longer.

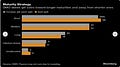

The yield on two-year bonds jumped as much as 13 basis points after the Debt Management Office announced £297 billion ($386 billion) of government bond sales in the fiscal year. While that was only slightly higher than expectations, investors pointed to official projections that imply around an extra £142 billion of borrowing over the next five years.

Listen to the Bloomberg UK Politics podcast on Apple, Spotify or anywhere you listen.

Traders adjusted for this looser fiscal policy by scaling back bets on monetary easing by the Bank of England. The market is now pricing just one more interest-rate reduction for the rest of the year, compared with two before Chancellor of the Exchequer Rachel Reeves’s announced her budget.

“Today’s budget was in fact a big fiscal loosening,” said Shaan Raithatha, a senior economist at Vanguard Europe. “We expect inflation and the BOE interest rate to fall more slowly as a result of today’s announcement, as stronger growth in the short run exerts upwards pressure on core inflation.”

CONTINUED…

Feel free to share with friends and colleagues!