(ZERO HEDGE) U.S. Banks Suffer BIGGEST Weekly Deposit OUTFLOW Since SVB Crisis 1 year ago!

READ THE ENTIRE ZERO HEDGE ARTICLE HERE!

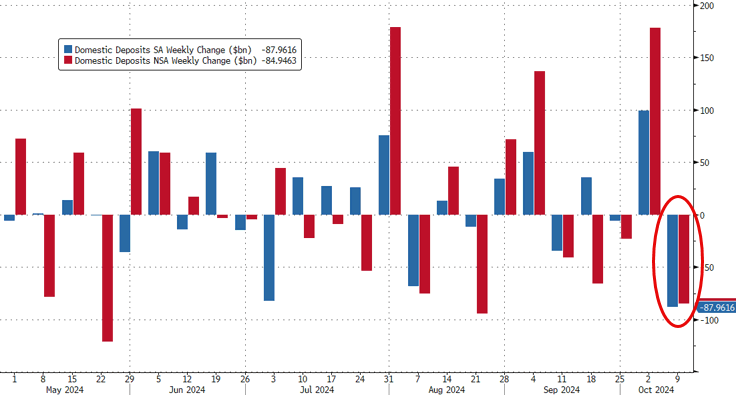

After the massive deposit inflows the prior week, US banks saw total deposits plunge in the week-ending 10/09 (latest data released today), down a stunning $69BN (on a seasonally-adjusted basis), erasing the prior two weeks deposit inflows...

Source: Bloomberg

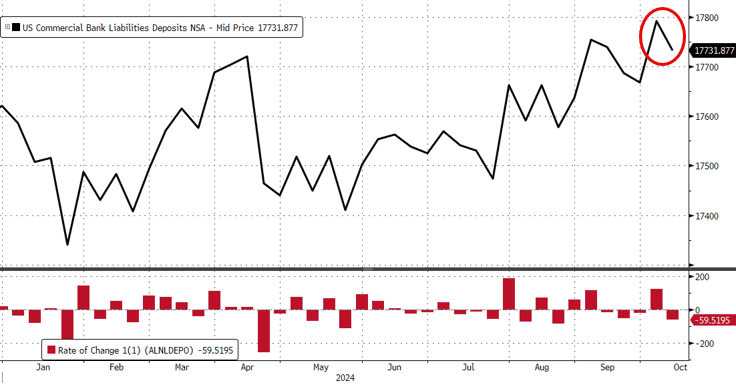

On a non-seasonally-adjusted basis, banks also deposit outflows ($59.5BN)...

Source: Bloomberg

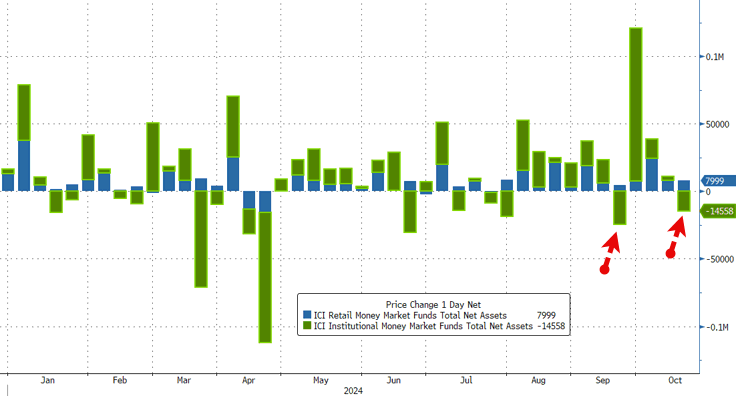

Additionally, for the first time in four weeks, money market funds saw (admittedly small) outflows this week (-$6.5BN), taking them just off record highs...

Source: Bloomberg

That is only the second weekly outflow from MM funds in the last three months... and the outflow was all institutional (with retail funds continuing to see inflows)...

Source: Bloomberg

Excluding foreign deposits, the US domestic bank deposit outflows were considerably worse, down $85BN (NSA) and $88BN (SA)...

Source: Bloomberg

That is the biggest weekly SA domestic deposit outflow since the SVB crisis in March 2023...

CONTINUED…

Feel free to share with friends and colleagues!