The major gold miners just achieved their greatest quarter in history! The potent combination of amazing record gold prices and solid cost control fueled record revenues, record unit profits, record bottom-line earnings, and record operating cashflows. This sector has never witnessed such an epic fundamental backdrop. Yet gold stocks remain deeply undervalued because most traders still haven’t recognized this.

The GDX VanEck Gold Miners ETF remains this sector’s dominant benchmark. Birthed way back in May 2006, GDX has parlayed its first-mover advantage into an insurmountable lead. Its $13.8b of net assets mid-week dwarfed the next-largest 1x-long major-gold-miners ETF by over 10x! GDX is undisputedly the trading vehicle of choice in this sector, with the world’s biggest gold miners commanding most of its weighting.

Gold-stock tiers are defined by miners’ annual production rates in ounces of gold. Small juniors have little sub-300k outputs, medium mid-tiers run 300k to 1,000k, large majors yield over 1,000k, and huge super-majors operate at vast scales exceeding 2,000k. Translated into quarterly terms, these thresholds shake out under 75k, 75k to 250k, 250k+, and 500k+. Those two largest categories account for over 53% of GDX.

Gold stocks have enjoyed a strong 2025, with GDX soaring 53.1% year-to-date in mid-April! That made for 2.0x upside leverage to the metal they mine, on the low end of its historical range of 2x to 3x. Gold’s underlying surge left it crazy-overbought, so it has been pulling back since. Thus gold stocks have been correcting in sympathy, with GDX falling 12.3% as of midweek. Such selloffs rebalancing sentiment are healthy.

Yet despite the gold miners’ rallying, they have vast upside remaining. From early October 2023 to early May 2025, gold rocketed 88.1% higher in a simultaneous mighty cyclical bull and monster upleg! Not a single 10%+ correction was suffered in that remarkable span. At GDX’s normal 2x-to-3x leverage due to gold miners’ profits amplifying gold, the major gold stocks should’ve skyrocketed 176% to 264% during that!

But GDX only climbed 92.9% through that huge gold run, pacing the metal at under 1.1x leverage! That extreme anomaly can’t and won’t last, gold stocks need to revalue much higher to reflect their fantastic fundamentals with these lofty prevailing gold prices. Somewhere between half to two-thirds of that huge move is still coming! So speculators and investors really need to do their homework and deploy in gold stocks.

For 36 quarters in a row now, I’ve painstakingly analyzed the latest operational and financial results from GDX’s 25-largest component stocks. Mostly super-majors, majors, and larger mid-tiers, they dominate this ETF at 85.6% of its total weighting! While digging through quarterlies is a ton of work, understanding the gold miners’ latest fundamentals really cuts through the obscuring sentiment fogs shrouding this sector.

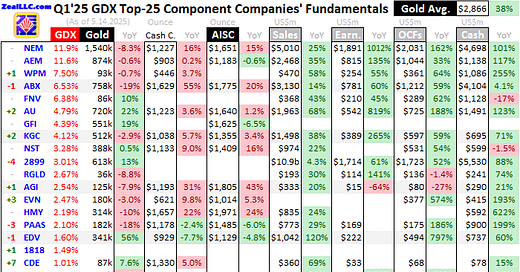

This table summarizes the operational and financial highlights from the GDX top 25 during Q1’25. These gold miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within GDX over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q1’24. Those symbols are followed by their current GDX weightings.

Next comes these gold miners’ Q1’25 production in ounces, along with their year-over-year changes from the comparable Q1’24. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After are the costs of wresting that gold from the bowels of the earth in per-ounce terms, both cash costs and all-in sustaining costs. The latter help illuminate miners’ profitability.

That’s followed by a bunch of hard accounting data reported to securities regulators, quarterly revenues, earnings, operating cash flows, and resulting cash treasuries. Blank data fields mean companies hadn’t disclosed that particular data as of the middle of this week. The annual changes aren’t included if they would be misleading, like comparing negative numbers or data shifting from positive to negative or vice-versa.

With last quarter’s average gold prices blasting up 38.3% YoY to a stunning record $2,866, gold miners’ Q1’25 results had to be awesome. And they truly were, exceeding my high expectations on most fronts. If traders knew how this sector is minting money, they’d be rushing in to chase the resulting enormous upside potential. Glorious quarterly results will certainly help build awareness of this gold-mining windfall.

CONTINUED…

READ THE ADAM HAMILTON ARTICLE HERE!

Feel free to share with friends and colleagues!

Great article. I am equally bullish on gold miners, as gold miners, if managed well, should be a great leveraged play on gold. The problem with miners, though, is that many (at least in the past) burned investors by not controlling the expense side adequately. But I think the industry (for the most part) has learned its lesson, and this time around, miners should be a good leveraged play on gold.

Part of my portfolio is allocated to gold miners.

Beyond that, Rick Rule, the legendary gold and silver investor, recently said: “You have no excuse not to make a million or two in this market.” Rick Rule shared which 22 mining stocks he owns in 2025.

https://ffus.substack.com/p/legendary-gold-and-silver-investor