Gold Plunges, Oil Tanks, and Silver Miners Soar—Dive Into March’s Explosive ASSET SENTIMENT TRACKER™ Now!

"Gold’s on a rollercoaster”

“oil’s tanking hard”

“Volatility is high.”

“It’s in a breakout move, but caution is advised against chasing the price.”

“In a secular bull market, but in a cyclical bear, cautious until the bear ends.”

…and you won’t believe what the experts are saying about silver miners, uranium & inflation-——DON’T MISS THIS!

Listen up, fellow investors—February’s Asset Sentiment Tracker™ report is here, and it’s packed with explosive insights that could shake up your portfolio. Our incredible team of industry heavyweights and experts, from Dr. Nomi Prins to Michael Pento to former President Ronald Reagan economic advisor Professor Steve Hanke, have laid bare their no-holds-barred takes on gold, silver, copper, uranium, the miners, oil, the Nasdaq/S&P 500 and where inflation is headed in 2025. But let me warn you: the numbers don’t lie, and some of these shifts are jaw-dropping.

Gold’s sentiment has plummeted 16% since January—why are the bulls suddenly cautious? And oil’s freefall to a measly 31.7 score? That’s a 29.6% nosedive, fueled by Trump’s “drill, baby, drill” obsession and market headwinds. You’ll find surprises like silver miners surging 12.6% in optimism, proving the real action might be underground. But here’s the kicker—there’s more hidden in these pages, and you’ll want to dig into the full report to see where the real value lies.

Premium Subscribers: Scroll down and dive right into the data. You’ve got the keys to the vault—use them!

Free Subscribers: Hold up—don’t settle for crumbs when you can feast on the full banquet. For just $30 per month (or receive discounts with an annual upgrade), you unlock every report, every month, including this one, with zero barriers. Why gamble with half the story when you can have the whole truth?

President Trump’s new team and policies is causing wild market volatility—fueled by his tariff threats, DOGE’s deregulation and abuse catching frenzy, a Mag7 growth slowdown, and looming economic jitters—is shaking markets to their core. Don’t let this chaotic policy whirlwind blindside your investments!

Upgrade now, and get the unfiltered, hard-hitting analysis you need to stay ahead of the curve. Trust me, this report’s gold mine of insights is worth the premium subscription alone. Click here to go premium before the next surprise hits.

Let’s pull apart the wreckage of February’s market chaos together—don’t miss out!

Dive into the Asset Sentiment Tracker now…

THE ASSET SENTIMENT TRACKER™ REPORT – MARCH 2025

This report aggregates insights from our industry experts, providing a comprehensive overview of their views on gold, silver, copper, uranium, oil, and major indices like the Nasdaq and S&P 500, plus inflation expectations and some discussions on bonds! Each asset is assigned a sentiment score based on expert rankings (1-100, where 100 is an extreme buy and 1 is an extreme sell).

Additionally, we include some expert comments and a summary conclusion for each asset. This month, we introduce a comparative analysis, showing March’s sentiment score alongside February’s, along with the differential and variance from one month to the next, allowing you to visually track asset sentiment trends!

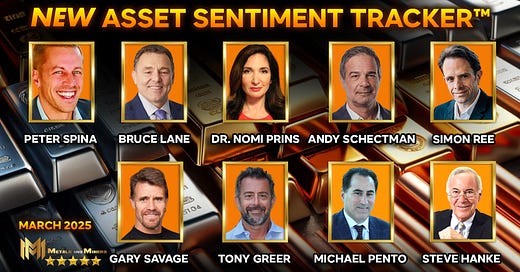

MEET THIS MONTH’S EXPERTS

This month’s insights are provided by a diverse group of industry experts, each bringing unique perspectives and expertise:

Peter Spina: Founder of GoldSeek.com and SilverSeek.com, a leading authority on precious metals and commodities. Follow his work at Goldseek.com or on X.

Bruce Lane: Uranium CEO specializing in Australian markets and commodities, with a focus on uranium and gold. Connect via LinkedIn or follow on X.

Dr. Nomi Prins: Former Wall Street executive and author, expert in global finance, metals, and energy. Follow on X or visit nomiprins.com.

Andy Schectman: President of Miles Franklin Precious Metals, specializing in gold, silver, and market trends. Follow on X or visit milesfranklin.com.

Simon Ree: Technical trader and market analyst, focusing on commodities and indices. Follow on X or visit his website for insights.

Gary Savage: Technical analyst and founder of The Smart Money Tracker, expert in market cycles and commodities. Follow on X.

Professor Steve Hanke: Former President Ronald Reagen economic advisor, Professor of Applied Economics at Johns Hopkins University, and renowned for monetary policy and asset analysis. Follow on X.

Michael Pento: Founder of Pento Portfolio Strategies, focusing on macroeconomics, bonds, and commodities. Follow on X or visit pentoport.com.

Tony Greer: Founder of TG Macro, macro strategist specializing in indices, commodities, and energy. Follow on X or visit tgmacro.com.

Keep reading with a 7-day free trial

Subscribe to Metals and Miners to keep reading this post and get 7 days of free access to the full post archives.