GOLDMAN SACHS: Gold Could Reach $6,000 Level, And Central Banks Will Be The Hidden Force Driving The Rally!

In this historic bull market for gold, the "gold-buying spree" by central banks worldwide has undoubtedly become a key driving force behind the rising gold prices. Although the true scale of these purchases by "central bank moms" remains a mystery, few industry insiders believe they will stop in the future...

Ask Aime: "Will Central Banks' Gold Buying Spree Continue to Drive U.S. Retail Investment?"

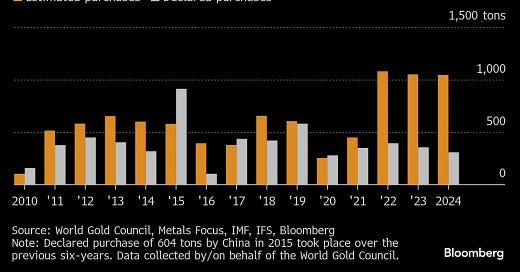

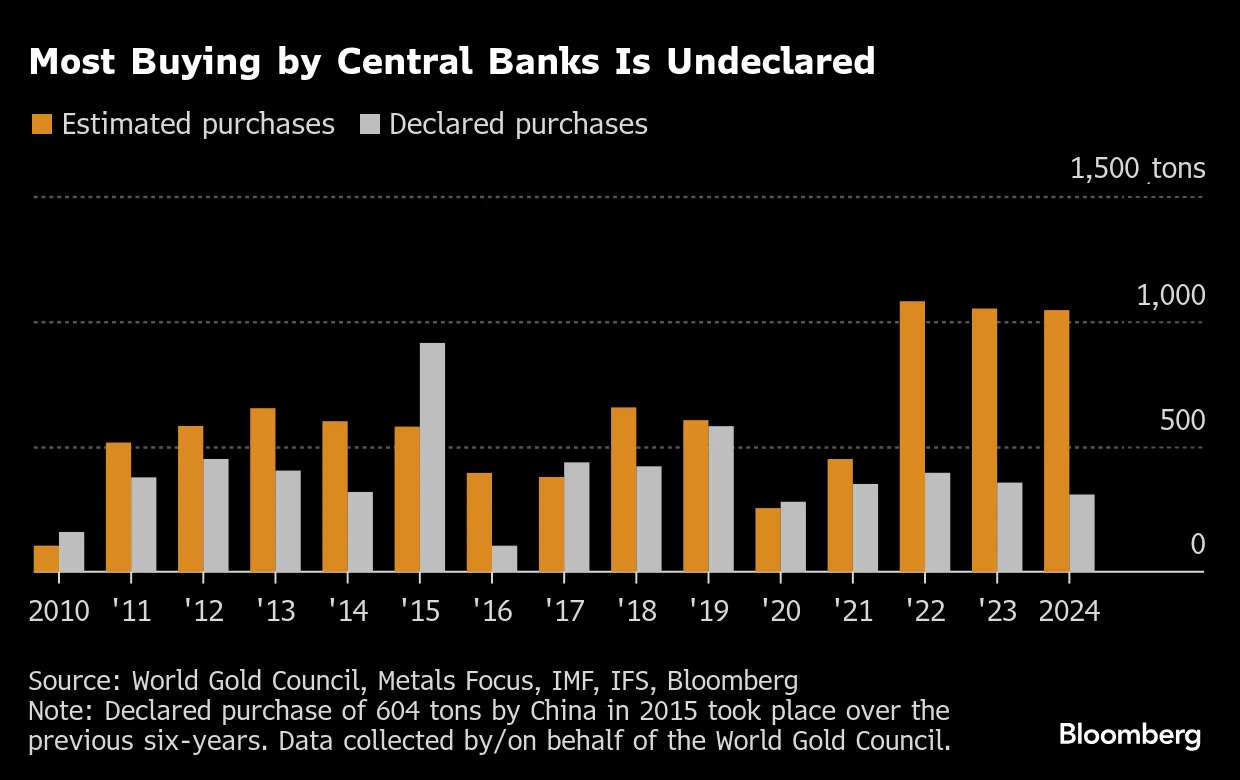

According to estimates by goldman sachs analysts, global central banks are currently increasing their gold holdings by approximately 80 tons per month- equivalent to about $8.5 billion at current prices. Most of these purchases are conducted secretly and privately.

Data from the World Gold Council leads to a similar conclusion: central banks and sovereign wealth funds collectively "sweep up" about 1,000 tons of gold annually, accounting for at least a quarter of the world's yearly gold production. A January survey by hsbc of 72 central banks showed that over a third of the respondents plan to buy more gold in 2025, with none intending to sell.

During periods of geopolitical tension, gold often plays the role of a safe haven.

Although this buying wave began before former U.S. President Donald Trump launched a global trade war, it highlights the growing concerns of some countries about over-reliance on the world's dominant reserve currency- the U.S. dollar. The scorching rally in gold prices over the past few years has only further enhanced the metal's appeal.

Ask Aime: Why is gold price surging?

One of the most representative examples is the national bank of Kazakhstan, which was one of the largest gold sellers among global central banks last year. However, according to its governor, Timur Suleimenov, the bank has now returned to being a net buyer this year and plans to continue increasing reserves.

A "Shortcut" to $6,000?

For Goldman Sachs, the belief that central banks' gold-buying spree will continue is a major reason the firm maintains its year-end price target of $3,700 per ounce.

As of Wednesday in Asian trading, spot gold was hovering around $3,365, not far from its all-time peak of $3,500 reached in April.

From the perspective of global central bank dynamics, their gold-buying pace nearly doubled after the 2022 Russia-Ukraine conflict led the U.S. and its Western allies to freeze Russia's foreign exchange reserves. This move to "weaponize finance" prompted many central banks to consider diversifying their reserves. Meanwhile, the threat of resurgent inflation and speculation that the U.S. government might be less accommodating to foreign creditors have further underscored gold's appeal to policymakers.

Adam Glapinski, governor of Poland's central bank- one of the largest gold buyers in recent years- said, "Gold is the safest reserve asset. It is free from direct links to the economic policy of any country, resistant to crises and retains its real value in the long term."

Massimiliano Castelli, Managing Director at UBS Asset Management, which provides strategic advice to many central banks, noted that, beyond sanction risks, speculation earlier this year about a potential Trump administration deliberately devaluing the dollar, as well as threats to the Federal Reserve's independence, has unsettled some institutions.

Castelli added, given the threats facing the U.S. dollar, its share in global reserves may continue to decline- perhaps slightly faster than in recent years, as central banks diversify into other currencies and gold.

That said, due to the limited issuance of bonds denominated in other currencies, central banks have few options when seeking diversification. Nonetheless, the increasing flow of funds into gold has become an irreversible trend, likely further supporting the price surge that began in late 2022 and has since doubled gold's value.

According to JPMorgan, shifting just 0.5% of foreign-held U.S. assets into gold in the coming years could be enough to push gold to $6,000 per ounce by 2029.

Evy Hambro, Global Head of Thematic and Sector Investing at BlackRock, thinks the gold market is large, but the dollar market is even larger. Even a small shift of funds from the dollar market into gold could have a massive impact."

READ THE AINVEST.COM ARTICLE HERE!

Feel free to share with friends and colleagues!

Fascinating breakdown — the central bank accumulation trend feels less like a temporary hedge and more like a structural shift in reserve strategy. If central banks continue quietly hoarding gold, how might this reshape retail investor behavior in the U.S.?