When we first made projections about the expected performance of gold for 2024 and beyond, it was a conservative estimate to suggest gold should average 12% or more per year for the next decade. These estimates today are on the low end for gold, with new forces at play taking gold much higher in the years ahead.

Today, we will update these projections and explain why 12% per year is likely too conservative for the conditions developing in the marketplace today.

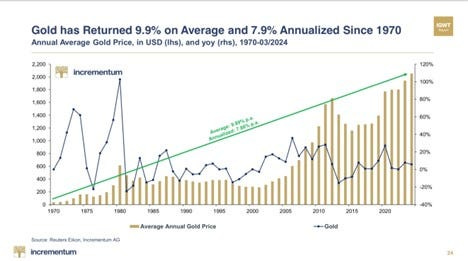

A 12% average increase in the price of gold provided a conservative starting place for estimates of future gold prices for the period 2023-2033, based simply on long-term historical averages for gold. For the previous decade, gold averaged only 4% per year.

But if we look back 20 years, 50 years, or longer, gold has averaged about 8% per year in annualized price gains. Getting gold back to historical norms for the next decade suggested an average of 12% or more for the next decade to keep the long-term average around 8%.

In simple mathematical terms, equal periods of 4% + 12% = 16%, divided by 2 periods = an 8% average per period. This does not mean that gold would rise 12% every year for 10 years in a row, as some years could be 6% and some years 18%, but it should average out to be 12% per year or so, conservatively.

But when we consider several factors developing geopolitically and in the precious metals arena globally, we may be at the start of a 5-year super-cycle for gold. There are periods throughout history when gold averaged 20-44% per year for 3-5 years.

TO ADD MORE VALUE FOR OUR PREMIUM SUBSCRIBERS AND TO HELP FUND THE SUBSTANTIAL OPERATING COSTS OF RUNNING METALS AND MINERS, WE ARE LAUNCHING THE INNER CIRCLE™: it is premium research, expert opinions, and actionable investment strategies on the metals and miners industry brought to you by the experts you have watched on the Metals and Miners YouTube channel. CLICK HERE TO BECOME A PREMIUM SUBSCRIBER TODAY!

These periods were marked by high inflation, recession, political instability, and changes to the financial world order. If you were to say, “That sounds like conditions we are seeing today,” you would be correct. This is why gold has risen over 30% in 2024 and may continue similarly for several years.

The World Gold Council projects an increasing demand for gold in the technology sector due to the continued expansion of “Artificial Intelligence” (AI) into nearly every facet of modern life. As AI continues to grow, so will the need for gold. Gold is essential to modern technological devices such as smartphones and electronic medical devices.

Gold is a great conductor of electricity, is malleable enough to fit into tiny spaces in various shapes, and doesn’t deteriorate due to humidity or temperature fluctuations.

CONTINUED…

READ THE ENTIRE USGOLDBUREAU.COM ARTICLE HERE!

Feel free to share this with your friends and colleagues!

I’m so grateful to everyone who has kindly supported me by becoming a premium subscriber to this substack. It’s making an important difference in helping me afford the substantial startup costs of running Metals and Miners.

Premium supporters now receive our popular THE INNER CIRCLE™ report service. They also gain access to the Metals and Miners Critical Reports Library, access to exclusive content not made available to the public, discounts to upcoming product and service offerings, and next month will begin receiving access to the new Metal Monitor™ report, which tracks the buying sentiment of the experts we interview on our YouTube channel, across the gold, silver, copper and uranium sectors.

Access THE INNER CIRCLE™ report here:

January 8, 2025: DAVE KRANZLER - Undervalued silver mining GIANT: a deep dive into this GROWTH STORY in the making!

COMING JANUARY 22ND, 2025: REPORT WRITTEN BY VINCE LANCI

If you, too, would like to become a premium subscriber to this Substack (it’s only $0.80/day), then sign up now below:

12 % annually would make a double in just 6 years = 5000 $ +....

and then double again to 10000$ + + in 10 years....and maybe overshooting a some stage...

the rules of 72 = 1 % interest take 72 years to Double...i.e 8% take 9 years = 8*9=72

Love this MATH ...BANK on it...

I wonder if a rogue actor, using an A.I. Agent could perform Asset Terrorism, where they lower or raise prices of commodities or hard assets into infinity? What prevents that mechanism to happen? What are assets worth to A.I.? A.I. needs energy so, does it want prices to be as high as possible or as low as possible?