Silver is gaining traction, helped by robust industrial consumption, a large supply deficit and lingering global uncertainty. Amid this backdrop, experts see more upside for the precious metal used to power the energy transition and diverse industrial applications.

In a Kitco interview, Keith Neumeyer, CEO of First Majestic Silver, said a combination of strong uptake and scarce supply has fueled the metal's rally in the past year. Prices soared to a 12-year high of over $34 an ounce in late October, though prices have largely remained around $31 an ounce since then.

"We are in a four-year deficit of around 240 million ounces (annually) and it's climbing every single year,” Neumeyer said.

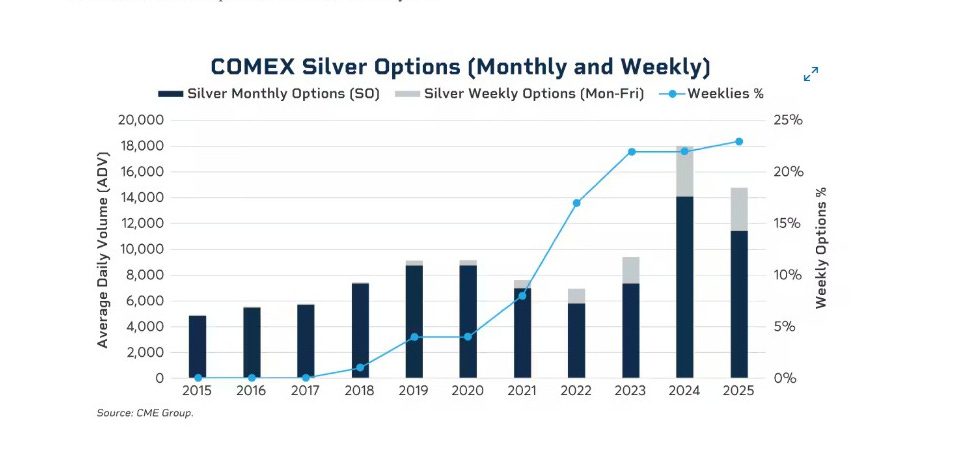

Silver's volatile supply and price dynamics have some investors turning to the derivatives market to manage risk. Last year, Silver options trading volumes at CME Group reached an all-time high of 18,027 contracts. Weekly options, which provide precise hedges around macro events, are contributing to over 20% of total Silver options volume in recent years.

“Ripe for Growth”

Michael DiRienzo, president and CEO of trade body The Silver Institute, said global silver demand reached 1.2 billion ounces in 2024, driven by the photovoltaic (PV) solar market which uses silver to make equipment such as solar panels.

Industrial consumption surged 7% to 700 million ounces, also driven by strong demand from electric vehicle (EV) powertrain and charging infrastructure, he added. Renewable energy growth and AI's surging electricity requirements, also bolstered sales.

And "the market is ripe for growth in 2025," enthused DiRienzo, adding that uptake could exceed last year's gains with electrification continuing across the globe.

Rising economic and geopolitical risks should continue to support silver, he added, as investors look to manage medium-to-long-term uncertainty.

DiRienzo noted that the closely watched gold-silver ratio (which tracks how many ounces of silver are needed to buy one ounce of gold) has also gained recently, raising silver's attractiveness. A rising ratio means silver is undervalued against its yellow cousin. The volatile gauge is hovering around 89 as of early March, up from an average of 60 during the past 20 years – though it briefly surged to 125 during the COVID-19 pandemic.

CONTINUED…

READ THE CME GROUP ARTICLE HERE!

Feel free to share this with your friends and colleagues!