THE INNER CIRCLE™: Vince Lanci's Navigating Silver Market Risks - The EFP, India, China, Central Banks & Beyond!

This installment of our popular THE INNER CIRCLE™ service for premium members of this Substack comes from Professional Commodity Portfolio Manager, Founder of Echobay Partners, longstanding University Professor (adj.) at UCONN, contributing editor to ZeroHedge, and publisher of the GoldFix newsletter Vince Lanci, whom I have interviewed on Metals and Miners back in August. To learn more about Vince and his work click here!

Vince is famous for his detailed and accurate reporting and analysis born of his vast experience in professional commodities trading and academia. This analysis by Vince is on the current silver market risks. Did you know that “Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply?” -BOA Metals

Here are the contents contained within this report prepared by Vince:

Overview: Silver Market Dynamics and Prospects

Resilience Amid Macro Headwinds

**Tariff Risks Mean Higher Price Risk

**The EFP: Canary in the Silver Mine

**India and China Premiums Persist

**Global Central Banks as Silver Buyers

Supply Constraints and Production Trends

Conclusion and Comments

This presentation by Vince Lanci is packed with critical to know information if you are currently invested or looking to be invested in the silver market! As a reminder, THE INNER CIRCLE™ is a bi-weekly rotating selection of premium analysis from many of the big thinkers interviewed on Metals and Miners.

Recent 2025 THE INNER CIRCLE™ reports include:

If you’re already a premium subscriber to this Substack, just continue below to access Vince’ entire presentation.

But if you’re not (yet), read the start of it below and consider upgrading to premium and access the full version, as well as all past and future THE INNER CIRCLE™ content.

Without further adieu here is Vince Lanci's Navigating Silver Market Risks - The EFP, India, China, Central Banks & Beyond!

Overview: Silver Market Dynamics and Prospects

On January 15th Bank of America released a special report titled Silver won’t lose its luster long-term covering Silver from the perspective of upside risk due to ongoing developments potentially coming to a head. We had already covered the Tariff and ETF risk in SILVER: Tariffs, EFPs, and Stockouts and were pleasantly surprised when a major Bullion bank took up the topic only days after our coverage.

Their report provides a comprehensive exploration of the silver market, dissecting near-term headwinds (Macro), structural fundamentals (BRICS demand), and potential shifts in demand dynamics ( Tariff/EFP risks).

This analysis underscores the metal’s resilience despite significant macroeconomic challenges, examining supply deficits, industrial demand, and the interplay of recent escalating geopolitical and regulatory factors in this regard.

Resilience Amid Macro Headwinds

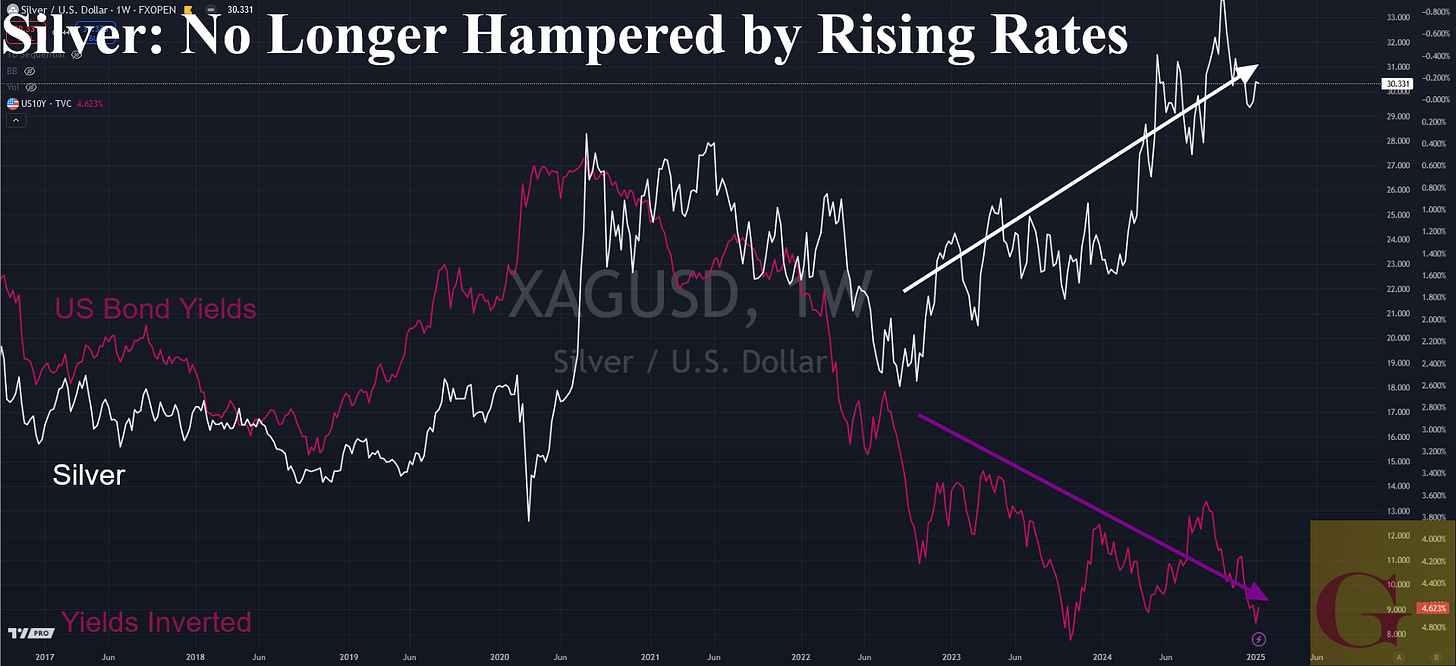

Silver prices have remained steady at approximately $30 per ounce over the past nine months, defying macroeconomic pressures such as a strong U.S. dollar, rising Bond yields and weakening industrial activity.

BOA attributes this stability to persistent supply deficits, exacerbated by underinvestment during prior bear markets. Global production is forecasted at 27Kt for 2024, still well below the 2016 peak by 1Kt.

This constrained supply has been exacerbated by growing industrial demand, particularly from sectors like renewable energy and electric vehicles. Solar panels and automotive technologies are increasingly reliant on silver, reinforcing its critical role in green energy transitions.

The analysis makes particular note of several interrelated items little discussed by any Bullion bank publicly before this report. First The Bank highlights potential disruptions stemming from the U.S. trade policy.

Broadly speaking, in context of the bigger supply/demand picture for Silver, two new significant developments are introduced:

What The Tariff Risk Means For Silver:

Keep reading with a 7-day free trial

Subscribe to Metals and Miners to keep reading this post and get 7 days of free access to the full post archives.