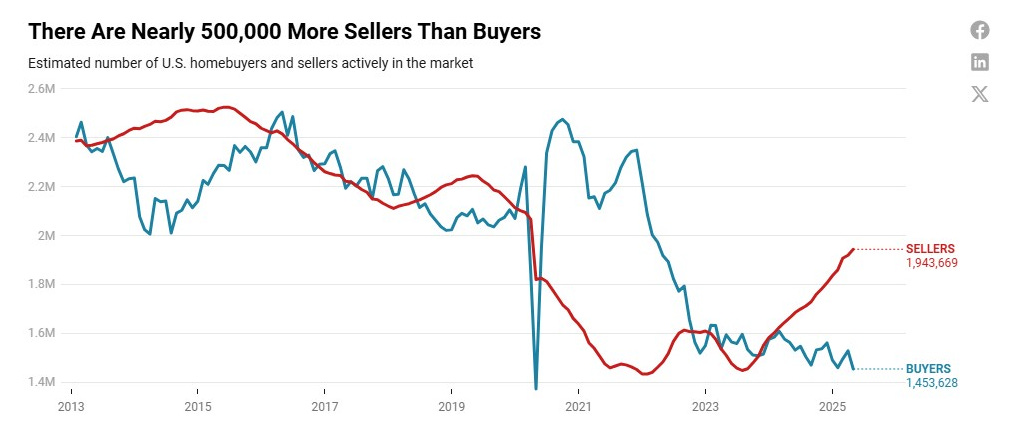

The U.S. Housing Market Has Nearly 500,000 More SELLERS Than Buyers—the Most on Record! (And layoffs haven't even really started yet!)

There are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. In other words, it’s a buyer’s market.

Redfin expects home prices to drop 1% by the end of the year as a result. Prospective buyers may see their purchasing power increase, and prospective sellers should consider selling sooner rather than later.

31 of the top 50 metros are buyer’s markets. The strongest buyer’s market is Miami, where sellers outnumber buyers roughly 3 to 1. The strongest seller’s market is Newark, and the most balanced market is St. Louis.

The condo market heavily favors buyers; there are 83% more condo sellers than buyers. By comparison, there are 28% more sellers than buyers in the single-family-home market.

There are an estimated 1.9 million home sellers in the U.S. housing market and an estimated 1.5 million homebuyers. In other words, there are 33.7% more sellers than buyers (or 490,041 more, to be exact). At no other point in records dating back to 2013 have sellers outnumbered buyers by this large of a number or percentage. A year ago, sellers outnumbered buyers by just 6.5%, and two years ago, buyers outnumbered sellers.

There haven’t been this many home sellers since March 2020. There haven’t been this few buyers at any point in records dating back to 2013 aside from April 2020, when the onset of the coronavirus pandemic brought the housing market to a halt.

The most recent data point in this analysis is April 2025. The estimated number of sellers in the market is simply the number of active listings in the MLS. To estimate the number of buyers, we created a model that uses data on pending sales and the typical time from a buyer’s first tour to their purchase. Scroll down for a full methodology and data on the 50 most populous U.S. metropolitan areas.

Redfin earlier this month predicted that home prices will drop 1% year over year by the end of 2025, and the growing imbalance between buyers and sellers is the basis for that prediction. When sellers are competing for a small pool of buyers, that indicates a buyer’s market. And when it’s a buyer’s market, home prices can fall because buyers have negotiating power.

Sellers outnumber buyers for several reasons:

It’s expensive to buy a home: High home prices and mortgage rates are scaring buyers off. The median home sale price rose 1.6% year over year to $431,931 in April. That’s the slowest growth in nearly two years, but monthly housing payments still hit a record high last month because mortgage rates and prices remain elevated. The average 30-year-fixed mortgage rate was 6.73% in April—more than double the record low hit during the pandemic.

Economic uncertainty: Tariff talks, layoffs, and federal policy changes are among the other factors dampening homebuyer demand. A recent Redfin survey found that nearly 1 in 4 Americans is scrapping plans to make a major purchase due to tariffs.

The mortgage rate lock-in effect is easing: Homeowners who have been sitting on ultra-low mortgage rates they scored during the pandemic are now giving up those low rates and selling their homes. That’s because for most people, it’s not realistic to stay put forever; job changes, return to office mandates and divorce force people to move. The idea of taking on a higher mortgage rate also isn’t as shocking as it was when rates first skyrocketed in 2022.

“The balance of power in the U.S. housing market has shifted toward buyers, but a lot of sellers have yet to see or accept the writing on the wall. Many are still holding out hope that their home is the exception and will fetch top dollar,” said Redfin Senior Economist Asad Khan. “But as sellers see their homes sit longer on the market and notice fewer buyers coming through on tour, more of them will realize that the market has adjusted and reset their expectations accordingly.”

CONTINUED…

READ THE REDFIN ARTICLE HERE!

Feel free to share with friends and colleagues!