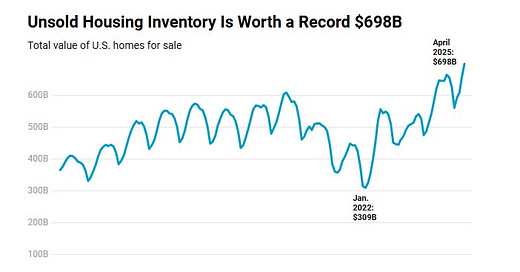

U.S. Home Sellers Are Sitting on Nearly $700 Billion Worth of Listings, an All-Time High!

More than $330 billion worth of listings have been sitting on the market for 60 days or longer. Rising inventory and slow homebuying demand is pushing up the total dollar amount of home listings, and will push down home-sale prices by the end of the year.

There’s a total of $698 billion worth of homes for sale in the U.S., up 20.3% from a year ago and the highest dollar amount ever.

This is based on an analysis of listings on Redfin.com going back through 2012. For the total dollar value of all inventory on the market, we sum up the list price of all active U.S. listings as of the last day of each month; April 2025 is the most recent month for which data is available. For the purposes of this report, the term “value” is interchangeable with “list price”; i.e., when we refer to “total home value,” we mean the sum of all list prices. We define “stale inventory” as home listings that spend at least 60 days on the market and are actively listed for sale on the final day of the relevant month. Please see the end of this report for more on methodology.

The total value of U.S. home listings is at an all-time high because of the combination of growing inventory, slowing demand, and increasing home-sale prices:

Housing supply is at a 5-year high. There are many more sellers than buyers in the market. The total number of homes on the market nationwide rose 16.7% year over year in April to its highest level in 5 years, with the mortgage-rate lock-in effect easing and homeowners trying to cash out due to economic uncertainty. New listings increased 8.6% to a 3-year high.

Homes are sitting on the market longer. The typical home that sold in April took 40 days to go under contract, 5 days longer than a year earlier. There’s also a growing share of inventory that has been sitting on the market for longer than two months; see the next section of this report for more details.

Homebuying demand is falling. Home sales are declining, and Redfin agents in much of the country report that would-be buyers are backing off due to record-high monthly housing costs and widespread economic instability.

Home prices are rising. The median U.S. home-sale price rose 1.4% year over year in April. Note that the total value of inventory is up by much more, 20.3% year over year, which signals that in recent years, the rising number of listings is a bigger factor in the total value of inventory than rising prices.

Another Redfin analysis found that there are nearly 500,000 more home sellers than buyers in today’s housing market. The fact that so many homes are being listed without buyers out there to purchase them, along with continually rising prices, explains why there are 12 figures worth of unsold inventory sitting on the market.

“A huge pop of listings hit the market at the start of spring, and there weren’t enough buyers to go around,” said Matt Purdy, a Redfin Premier agent in Denver. “House hunters are only buying if they absolutely have to, and even serious buyers are backing out of contracts more than they used to. Buyers have a window to get a deal; there’s still a surplus of inventory on the market, with sellers facing reality and willing to negotiate prices down.”

CONTINUED…

READ THE REDFIN ARTICLE HERE!

Feel free to share with friends and colleagues!