DR. NOMI PRINS (PRINSIGHTS GLOBAL): The A.I. - Energy Revolution - Fueled by the White House and Rare Earth Metals! (and China!)

President Trump deployed a whirl of executive orders and government policy directives in his first week in office. Much of the actions and consequences are still being dissected at the state and local level.

With all the reactions, it is hard not to get caught up in the politics and headlines. Now, to be clear, volatility is likely the outcome from here on out. However, it’s the subtle but significant policies that can have major impacts over the long term.

For investors and financial analysts, working to navigate through the noise and unpack what political headwinds and tailwinds could mean for the markets is where opportunities emerge.

That’s why understanding what’s in the recent White House executive orders that were issued matters. You see, a swath of the policies are being aimed at bolstering domestic production of critical minerals and strengthening the U.S. energy supply chain. Yes, much of that was done to reduce the U.S. foreign dependence on trade and boost energy security, but there's a hidden beneficiary that investors should be paying close attention to: artificial intelligence (AI).

As we detailed earlier this month and in December, AI, particularly the development of advanced models and their applications, requires massive amounts of computational power.

This translates to a massive demand for energy.

You can also check out THE INNER CIRCLE™ report - it is a rotating selection of premium research, expert opinions, and actionable investment strategies on the metals and miners industry brought to you by the big thinkers I interview on the Metals and Miners YouTube channel.

The premium 2025 THE INNER CIRCLE™ reports can be found here:

Becoming a premium subscriber to this Substack is only $0.80/day!

Why AI Needs a Power Up in the U.S.

As we’ve noted, data centers, the backbone of AI development, are notorious energy hogs. As AI models become even more complex and data sets grow larger and more complex over the months and years, this energy demand will only increase.

Leaders in Washington are well aware of this. And while much of the conversation has been on filling any strategic vulnerabilities that are posed by China’s significant supply of rare earth metals, the fact remains that energy security for any government – especially one with a highly developed economy – is crucial for financial and long-term stability.

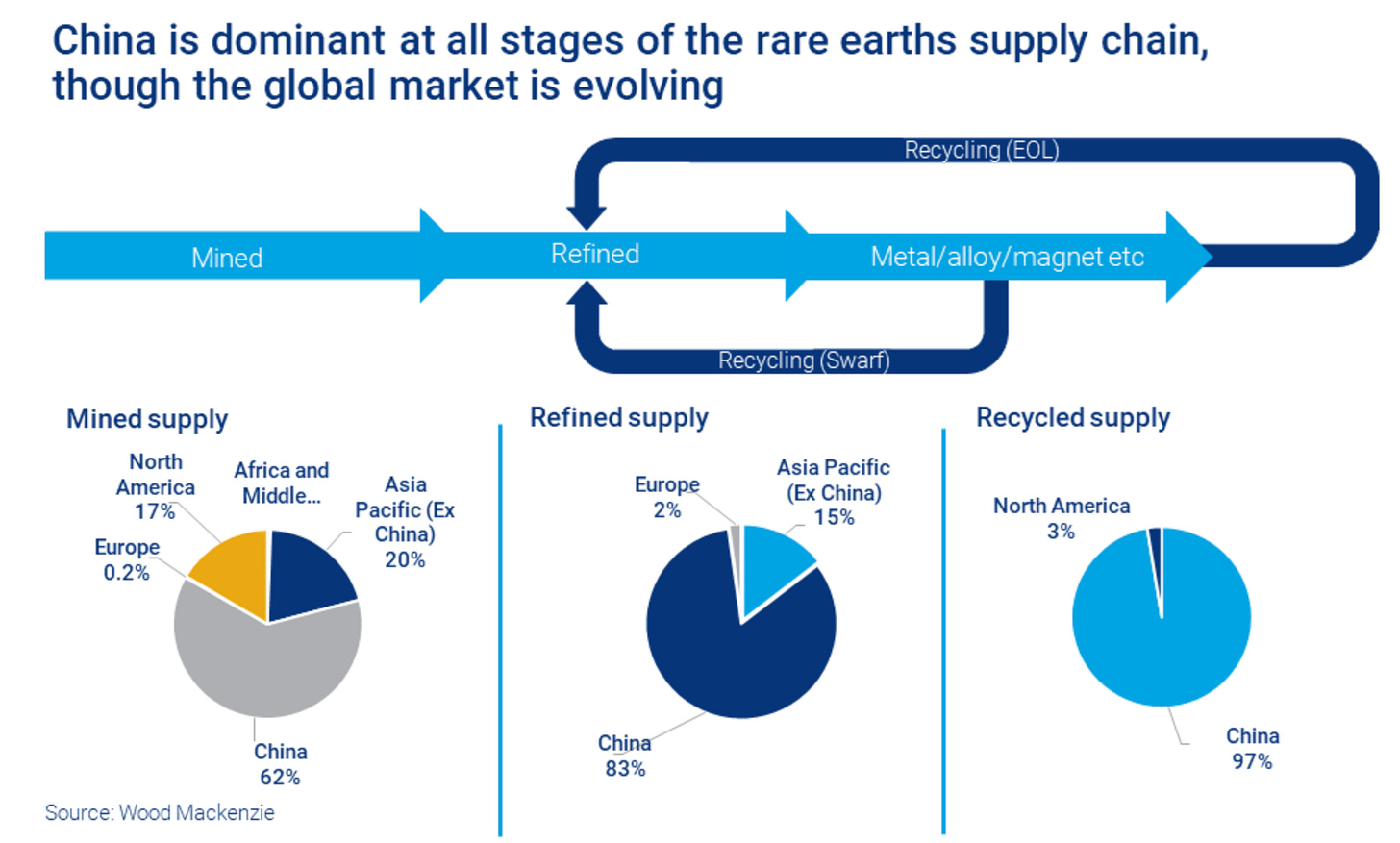

In this regard, we are on a heightened collision course of U.S.-China competition. The realpolitik ramifications of not only Chinese AI but of their stronghold on rare earths is considerable.

“It’s not like China is standing still,” said Morgan Bazilian, the director of the Payne Institute at the Colorado School of Mines. It’s “also making massive investments all over the globe in minerals and companies and mining and processing and also all the way down to advanced manufacturing.”

CONTINUED…

READ THE ENTIRE PRINSIGHTS GLOBAL POST HERE!

Feel free to share this with your friends and colleagues!